Gen Z, the most ambitious generation ever, currently makes up 30 percent of the world’s population and is expected to reach 27% of the workforce by 2025.

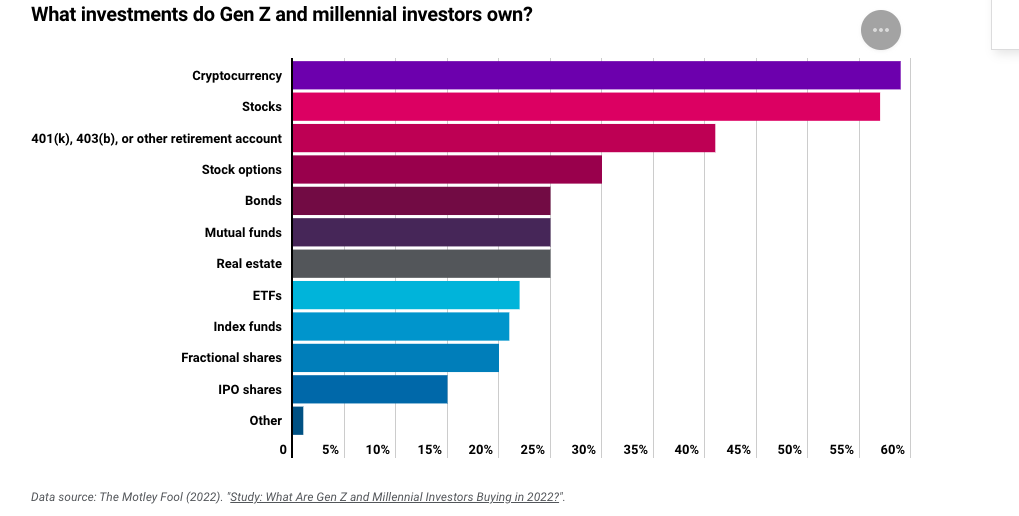

Like other interests, they are also severe and cautious about investments. Although they are less likely to have a retirement account than prior generations, Gen Z and millennial investors are more likely to buy stock options and cryptocurrencies.

Fintech Mobile App can be a valuable tool for Gen Z to save money by offering budgeting and expense tracking features, automated savings, cashback rewards, investment options, and financial education resources.

Here you can seize an opportunity by launching the Fintech Mobile App packed with some never seen features to gain the attention of this smart generation.

What is Fintech Mobile App

A fintech mobile app provides financial services and products through mobile devices such as smartphones and tablets. "fintech" refers to integrating financial services with technology to improve the customer experience and increase efficiency.

Fintech App Development allows businesses to offer various financial services, including online banking, mobile payments, budgeting, personal finance management, investment management, lending and borrowing, insurance, and more.

Fintech mobile apps are becoming increasingly popular among consumers who prefer to manage their finances on the go. They are also gaining traction among businesses looking to streamline their financial operations.

Benefits Of Fintech Apps For Gen Z

Fintech apps can offer several features and benefits that can help Gen Z save money; some of them are:

- Budgeting and tracking expenses: Fintech Mobile App allows users to create a budget and track spending. It helps them to identify where they are overspending and adjust their spending habits accordingly.

- Automated savings: Fintech Mobile App can automatically transfers money from a bank account to an investment account. Some apps even use algorithms to analyze spending patterns and automatically transfer money to savings based on the user's spending habits.

- Investment options: Some fintech apps offer low fees and minimum investment requirements, making it easy for Gen Z to start investing small amounts of money. Investing can help them grow their savings over time.

- Financial education: Many fintech apps offer resources and tools to help users improve their financial literacy. By learning about personal finance, Gen Z can make better financial decisions and save more money.

Essential Features Of The Fintech Mobile App

A fintech mobile app is a financial technology app that provides its users with various financial services. Here are some essential features that a fintech mobile app should have:

- A fintech mobile app should have a simple and intuitive interface that makes it easy for users to navigate and use the app. That's why it is crucial to hire an experienced Financial App Development Company that can develop easy-to-use fintech apps.

- Data security is crucial for fintech apps. It's essential to add two-factor authentication in your financial app to protect users' information. That's why you give your app development to secure hands with experience developing fintech apps.

- Add an account management feature to allow users to manage their accounts, view transaction history, and check their account balances in one click. With advanced fintech mobile app development services, you can offer some incentives or perks after reaching preset investment milestones.

- Payments and transfers are the standard features of a fintech app that you can’t ignore. This feature allows users to make payments, send and receive money, and transfer funds between accounts.

- Add a budget tracking feature to allow users to keep track of their spending and manage their finances effectively. You can use graphs and charts to show the investments of users.

- Add an investment options feature to allow users to invest in stocks, bonds, mutual funds, or other investment vehicles. Users can personalize their experience by customizing their dashboard or setting up alerts for specific transactions.

- Add notifications and alerts feature to send notifications and alerts to users for account activity, such as transaction confirmations, balance updates, and payment reminders.

- Add a customer support feature, such as a chatbot or a live customer support agent.

Cost of Fintech App Development

The cost of developing a fintech app can vary widely depending on several factors, including its complexity, the platform(s), and the customization and functionality required.

Here are some factors that can influence the cost of fintech app development:

.jpg)

To get a more accurate estimate of the cost of developing your fintech app, consult with the Financial App Development Company.

Tech Stack For Fintech App Development

The tech stack for fintech app development can vary depending on the specific needs and requirements of the application. However, here are some technologies and tools that most mobile app development companies use in fintech app development:

1. Programming languages: Java, Python, Ruby, JavaScript, Kotlin, Swift, and Go

2. Frameworks and Libraries: AngularJS, React, Ruby on Rails, Django, jQuery, Bootstrap, and Chart.js

3. Databases: PostgreSQL, MySQL, MongoDB, and Oracle.

4. Payment Gateway Integration: PayPal, Stripe, and Braintree.

5. Cloud Platforms: Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure

6. Data Analytics: Apache Spark, Tableau, and Google Analytics

7. Security: SSL/TLS, firewalls, intrusion detection systems, and encryption

8. Compliance: GDPR, PSD2, and KYC/AML

Top 5 Fintech Apps For Gen Z

We've created a list of the top 6 fintech products for Generation Z. These applications are worth knowing since they have been able to appeal to a tech-savvy youth that is constantly on the go and has little patience for slow-performing apps. See what these technologies offer that makes financial duties enjoyable for young people by looking at the list below.

The French app is exceptionally user-friendly and improves the experience of giving and receiving pocket money. Pixpay has an advantage over other finance apps because many forbid accounts for those younger than 18 or 14. It's one of the most kid- and teen-friendly financial applications available, enabling young members of Generation Z to handle their money securely.

Quirk assists individuals in personalizing their financial management. The app offers an original approach to customized financial services, identifying users' interests, requirements, and spending preferences through a personality test. Expert psychologists have endorsed the psychological foundations on which these exams are built. They also exchange knowledge and suggestions for bettering expenditure practices. Quirk offers a customized product experience by utilizing behavioral research.

Cleo is another best Fintech Mobile app that helps users to invest their money safely. This app uses an AI chat boat to guide you in financial investment. Their various other features that you can use within this Fintech Mobile App to thoughtfully invest your money. If you want to design an app like this, hire an experienced Financial App Development Company like Consagous to develop a feature-rich fintech app.

Paid enables gig economy employees and freelancers to get paid immediately when their task is finished. By serving as a middleman between freelancers and their clients, the app ensures that working together runs well for everyone involved. Paid offers the assurance that you will be paid within three days of finishing an assignment, but they also charge a modest fee for this service. Paid furthermore handles some administrative duties, freeing freelancers to concentrate on their connections with clients and clients.

Key Takeaways

Today’s Fintech Application Development Companies have gone above and beyond to launch intuitive and feature-rich finch apps. They’re constantly working to enhance the functionaries of their app after understanding their audience’s behaviors and thinking patterns.

If you want to design a fintech mobile app to deliver enjoyable experiences around financial planning and give them a holistic approach to investing, contact Consagous—a true fintech application development company, to discuss your idea.

Get Free Consultation

Let our extended team be part of your journey and help you.